Your Partner in Predictable Wealth Growth

Achieving 2% Monthly Returns Through Strategic, Data-Driven Investments

Our Approach

Strategic Solutions for Consistent Growth

Targeted Returns

Achieving 2% monthly growth through disciplined investment strategies.

Expert Insights

Leveraging market expertise to identify and capitalize on opportunities.

Data-Driven Decisions

Utilizing advanced analytics for informed and effective investments.

Risk Management

Employing robust strategies to mitigate risks and ensure stability.

Transparent Operations

Maintaining clear communication and transparency with all investors.

Tailored Strategies

Crafting personalized investment plans to meet specific financial goals.

Our Investment Strategy

- Focused Targeting: Identifying high-potential opportunities through comprehensive market analysis.

- Diversified Portfolio: Balaning investments across multiple asset classes to reduce risk.

- Active Management: Continuously monitoring and adjusting positions to capitalize on market dynamics.

- Quantitative Analysis: Leveraging data-driven models for precise and informed investment decisions.

- Adaptive Techniques: Adjusting strategies to align with evolving market conditions and investor goals.

Executive Team

John Robert Picinic

President | Founder

John, a seasoned day trader with Wall Street lineage, has expertly targeted annual returns of up to 132% since 2008. His refined approach to short-term market movements, coupled with a commitment to risk management, consistently drives exceptional financial growth.

Ready to Elevate Your Trading Game?

Explore Our Range of Tailored Services and Take the First Step Towards Financial Freedom Today!

Blog

Insights & Analysis

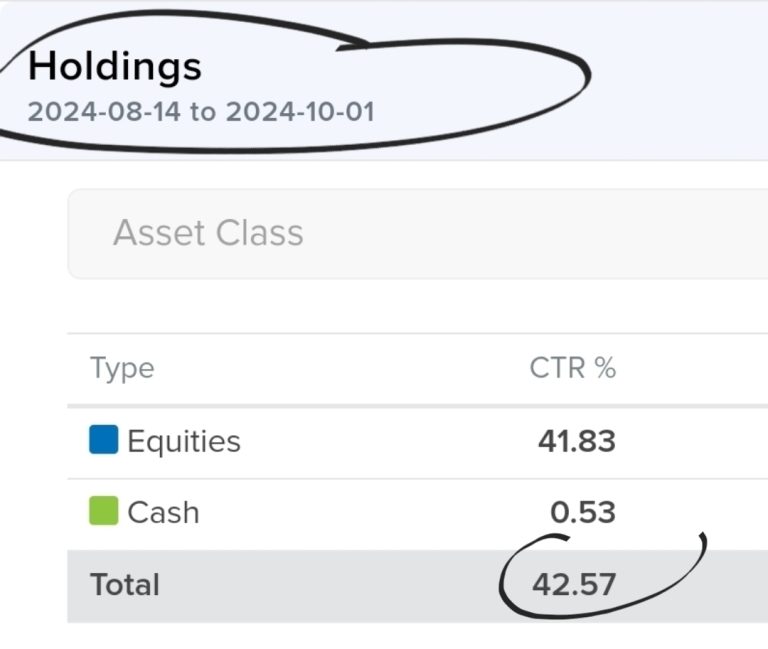

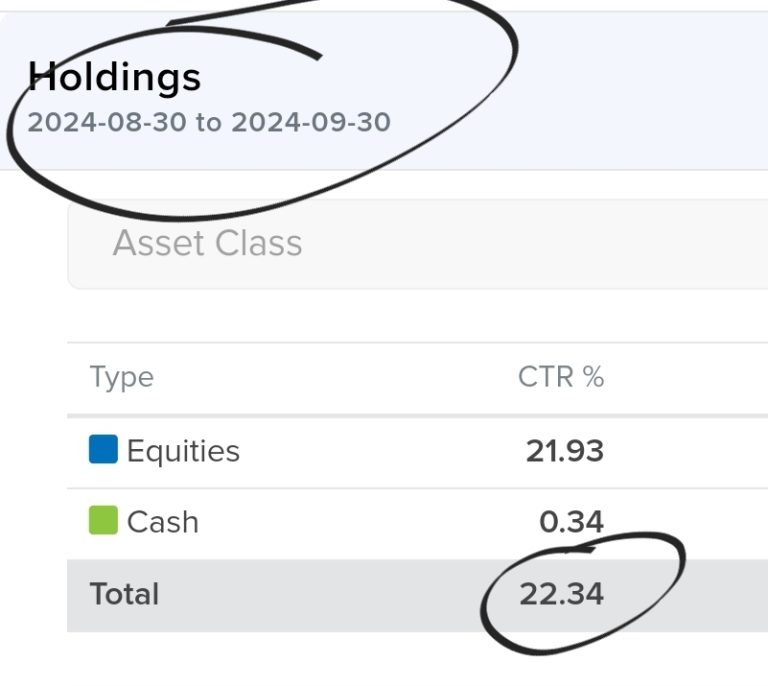

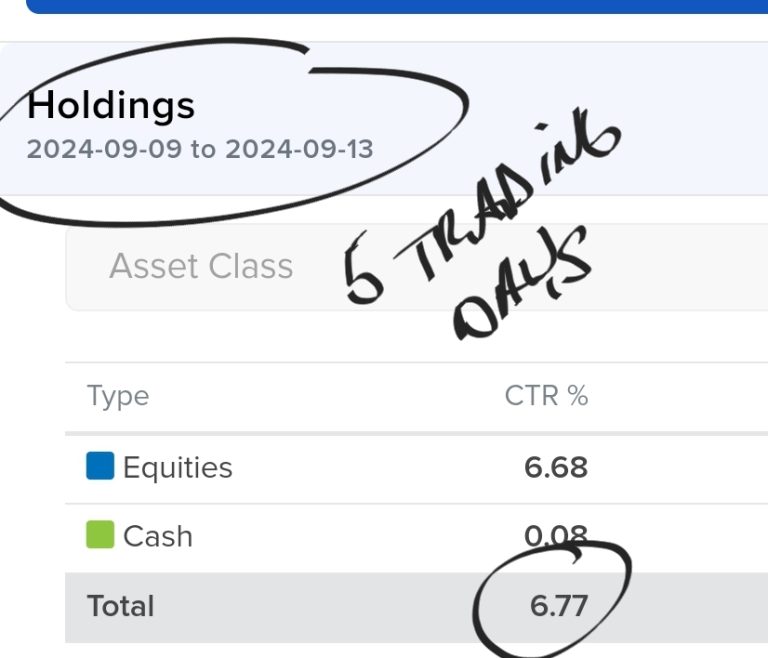

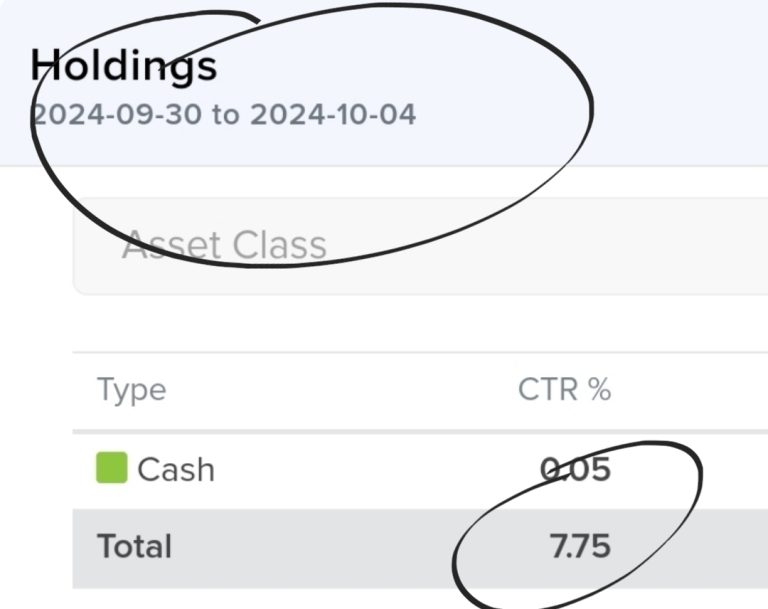

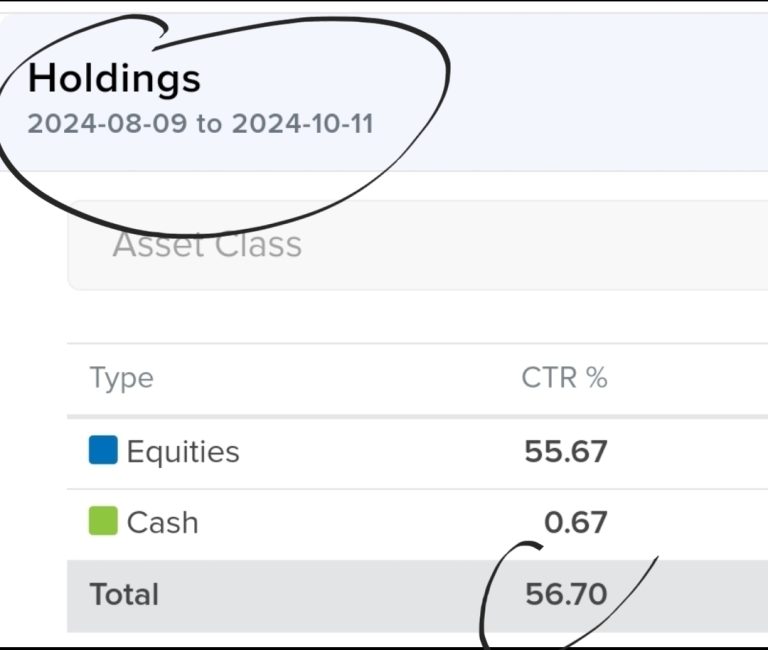

Proven Results

F.A.Q.

Find answers to commonly asked questions about our services and trading strategies

What kind of returns can I expect from JRP Analytics?

At JRP Analytics, we target a 2% monthly return for our investors, using disciplined investment strategies and data-driven insights to ensure consistent and reliable growth.

What is the minimum investment required?

The minimum investment to participate in our portfolio is $100,000. This ensures access to our carefully managed and diversified strategies that target steady wealth growth.

How do you manage risk in volatile markets?

We implement strict risk management protocols, including a 7% risk size limit on all investments. Our diversified trading approach spans options, stocks, and futures, ensuring we capture opportunities while minimizing exposure.

What makes JRP Analytics different from other investment firms?

We leverage advanced analytical techniques and personalized strategies to target consistent 2% monthly returns. Transparency, robust risk management, and a team of seasoned professionals set us apart in the financial industry.

How is transparency maintained with investors?

We prioritize clear communication with all investors, providing regular updates and transparent insights into our strategies and performance, ensuring you’re always informed about your investments.

Is JRP Analytics suitable for long-term growth?

Yes, our focus is on sustainable, long-term wealth growth. We employ data-driven strategies and continuously adjust our approach to align with market dynamics, ensuring steady returns over time.